Partnership EnableNow and RiskQuest

- 06-06-2023

- 3 min

We are proud to share that EnableNow is partnering with RiskQuest. By joining forces, we can now provide our customers with real-time insight into transaction data via the RiskQuest Navigator dashboard. On top the RiskQuest algorithm can automatically calculate credit risk.

RiskQuest Navigator

RiskQuest Navigator

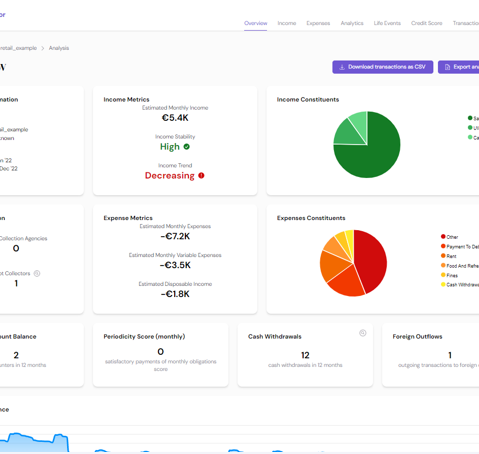

The RiskQuest Navigator is an innovative tool that can label and categorize transaction data based on a strong algorithm for both the retail and corporate market. The results are displayed in a clear dashboard (see image). This dashboard provides in-depth insight into the account holder's income, expenses, withdrawals, deposits and even life events such as unemployment or retirement. The combination of analysis leads to a credit score based on payment behavior, income and fixed expenses.

EnableNow and RiskQuest

EnableNow is the Open Banking platform in the Netherlands. We help our customers to gain smart insights based on transaction data. Thanks to our focus on the Netherlands, we provide an Open Banking platform that seamlessly matches the specific characteristics of the Dutch market.

With the help of RiskQuest's knowledge and technology, we can now offer our clients an in-depth credit risk analyses. In the EnableNow/RiskQuest combination, EnableNow takes care of the customer journey and the connection with the bank. RiskQuest provides the data analysis and the dashboard. This combination is ideal for organizations that want to quickly gain insight into credit risk, such as factoring companies, credit and mortgage providers.

About RiskQuest

With over 15 years of experience in credit risk models, RiskQuest is a leading specialist in credit risk analyses, fraud detection and data enrichment. RiskQuest works for the largest banks in the Netherlands and has an extremely strong team of financial professionals and developers.

Long-term cooperation

We look forward to a long-term collaboration with the motivated team of RiskQuest. Want to know more of what this partnership could mean for your organization? Then please contact us.

Read on

- 02-04-2025

- 5 min

As president of EnableNow, I look back on the past year with pride and look forward with great enthusiasm to what 2025 will bring us. EnableNow is at the center of the fintech world, where the pace of change is fast and our customers' expectations continue to grow.

In this blog, I share the key milestones of 2024 and our plans for the period ahead.

- 02-04-2025

- 3 min

At EnableNow, we continue to continually expand and refine our portfolio. We specialize in digital on-boarding and monitoring solutions.

In this we work together with several partners such as Documaticplus. Through a combination of functionalities, our services can be used for any organization.

Discover the possibilities of Open Banking for your organization!

Curious about how EnableNow can help you benefit from the possibilities that PSD2 offers? Contact us without obligation!

+31 (0)73 - 2340069Contact us